One of the many reasons to buy a home is that it’s a major way to build wealth and gain financial stability.

According to Freddie Mac:

“Building equity through your monthly principal payments and appreciation is a critical part of homeownership that can help you create financial stability.”

With spring approaching, now’s a great time to consider if buying a home makes sense for you. The best way to figure that out is to talk with a trusted real estate professional.

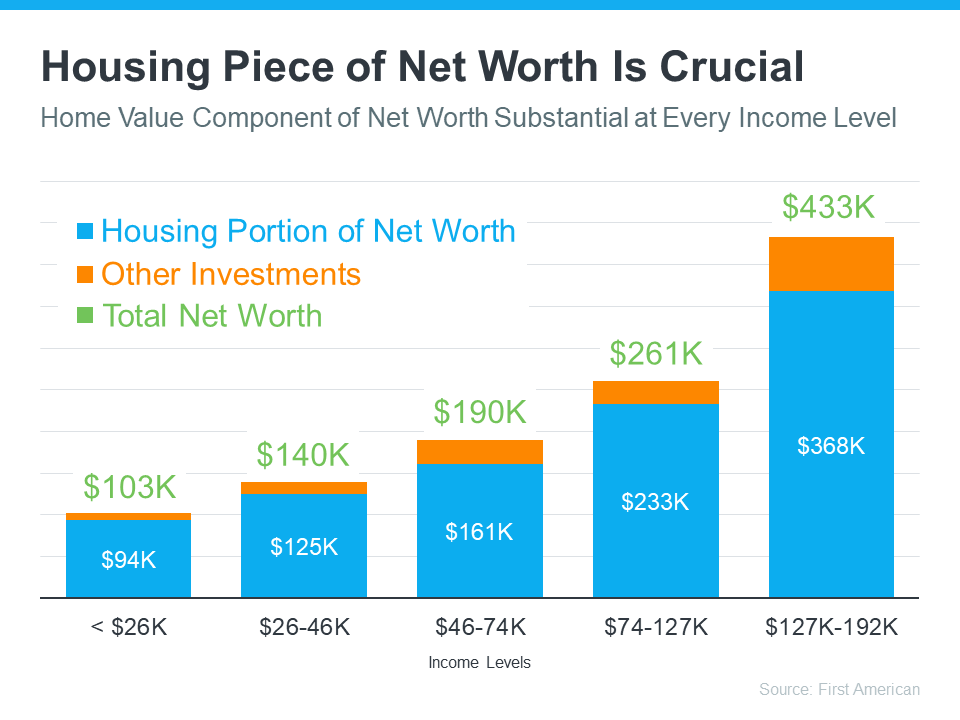

The Largest Part of Most Homeowners’ Net Worth Is Their Equity

You may be surprised to learn just how much of a homeowner’s net worth actually comes from owning their home. The National Association of Realtors (NAR) shares:

“Homeownership is the largest source of wealth among families, with the median value of a primary residence worth about ten times the median value of financial assets held by families. Housing wealth (home equity or net worth) gains are built up through price appreciation and by paying off the mortgage.”

In other words, home equity does more to build the average household’s wealth than anything else. And according to data from First American, this holds true across different income levels (see graph below):

Bottom Line

One of the biggest benefits of owning a home, regardless of your income level, is that it provides financial stability and an avenue to build wealth. Let’s connect today so you can start investing in homeownership.

Certified Residential Specialist • COMPASS • Agent License: #22727

Selling or buying your home shouldn’t be a stressful ordeal. Making the smart move of choosing a REALTOR® is your first step to ensuring that your investment in your home pays off. My services and experience allow you to focus on your move while I manage your home sale from our initial consultation to the closing and beyond. I pride myself on repeat business and hope you’ll come to understand why.

Experience to get you home. Contact me if you are thinking of making a move.

- 410-459-4445 mobile

- 410-886-7342 office

- nancy@livetowson.com

![key-housing-market-trends-[infographic]](https://www.livetowson.com/wp-content/uploads/2023/07/13550-key-housing-market-trends-infographic.png)